Press Releases

25.04.2024

TAV Airports served 17 million passengers in Q1

TAV Airports announced the financial and operational results of the group pertaining to the first quarter of 2024. The company disclosed EUR 321M in revenues.

Learn More ->

18.04.2024

TAV's five airports to receive awards in Frankfurt

The airports operated by TAV Airports - Almaty, Batumi, Madinah, Milas-Bodrum, and Tbilisi - were among the best in the World Airport Awards 2024, organized by Skytrax and determined by passenger choices.

Learn More ->

21.03.2024

TAV Airports to expand capacity at Madinah Airport

TAV Airports, together with its consortium partner, will invest a total of USD 275 million in Madinah, to increase terminal capacity. A new domestic terminal will be built, and the existing terminal will be developed to accommodate 18 ...

Learn More ->

11.03.2024

TAV's four airports to receive service quality awards

Izmir Adnan Menderes, Milas-Bodrum, Skopje, and Zagreb airports, operated by TAV Airports, a member of Groupe ADP, have been acknowledged as best airports in the Airports Council International (ACI World) ASQ Awards.

Learn More ->

13.02.2024

TAV Airports announced EUR 1.3B revenue in 2023

TAV Airports announced the full-year financial and operational results for 2023. The company served 96 million passengers, with a 22% increase compared to the previous year.

Learn More ->

24.10.2023

TAV Airports announces EUR 982M revenue in nine months

TAV Airports announced the financial and operational results for the first nine months of 2023. The company served 74.6 million passengers, with a 24% increase compared to the same period last year.

Learn More ->

07.09.2023

TAV's three airports to receive service quality awards

Ankara Esenboğa, Skopje, and Zagreb airports have been recognized among the best airports in the Airport Service Quality (ASQ) Awards by the Airports Council International (ACI World). These awards, determined by passenger evaluations,...

Learn More ->

26.07.2023

TAV Airports announced EUR 560M first-half revenue

TAV Airports announced the financial and operational results of the group pertaining to the first half of 2023. The company served 39.3 million passengers in six months.

Learn More ->

07.07.2023

TAV named "Great Place To Work" again

TAV Airports has once again earned the certification from Great Place to Work, one of the world's leading human resources research institutes known for its work on corporate culture. Through their evaluations, Great Place to Work recog...

Learn More ->

26.06.2023

Enhanced Airport Accessibility Experience for Visually Impaired Passengers by TAV

TAV Airports has collaborated with WeWALK to enhance the accessibility of airports for visually impaired passengers. As part of this collaboration, visually impaired passengers at Antalya, Ankara Esenboğa, İzmir Adnan Menderes, Milas-B...

Learn More ->

24.05.2023

Ankara Esenboğa Airport Welcomes FlyArystan's First Astana Flight

FlyArystan has started direct flights between Ankara Esenboğa Airport and Nursultan Nazarbayev Airport. Passengers arriving from Astana were greeted with a ceremony at the airport.

Learn More ->

17.03.2023

TAV’s six airports ranked among the best in Skytrax

Operated by TAV Airports, the Almaty, Antalya, Batumi, Madinah, Tbilisi, and Zagreb airports have been named among the best at the 2023 Skytrax World Airport Awards, which were determined by passenger choices.

Learn More ->

07.03.2023

TAV's three airports are among the best in the world

Operated by TAV Airports, Ankara Esenboga, Skopje and Zagreb airports have received the prestigious Airport Service Quality award.

Learn More ->

20.12.2022

TAV extends Ankara concession until 2050

TAV Airports gave the best offer to operate Ankara Esenboğa Airport for another 25 years for a concession fee of €475 million plus VAT. During this period TAV will make an investment of approximately € 300 million to develop the gatewa...

Learn More ->

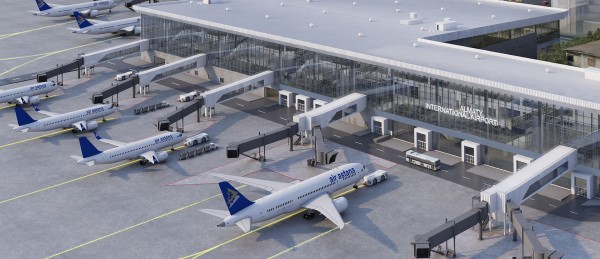

12.12.2022

TAV Technologies continues to grow in Central Asia

26.10.2022

TAV announces EUR 753M revenue in the first nine months

TAV Airports served 60.2 million passengers during the first three quarters. Due to a favorable operational and financial backdrop, the company revised its 2022 year-end guidance upwards.

Learn More ->

30.09.2022

TAV Airports makes the “Best Workplaces for Women” list with three subsidiaries

Food and beverage subsidiary BTA, hospitality brand TAV OS and general aviation subsidiary TAV Air named among the 27 companies selected through the GPTW Institute surveys.

Learn More ->

15.09.2022

TAV’s six airports received service quality awards in Krakow

Operated by TAV, Izmir Adnan Menderes, Ankara Esenboğa, Madinah, Tbilisi, Zagreb, and Skopje airports received the best airport awards in their categories at the ACI Customer Experience Global in Krakow, Poland this year.

Learn More ->

27.07.2022

TAV served 29.9 million passengers in the first half of 2022

TAV Airports disclosed EUR 31 million net profit for the first six months of the year. Passenger traffic increased by 129%, while international traffic jumped by 235% compared to the previous year, as the momentum of recovery picks up ...

Learn More ->

21.07.2022

TAV Technologies carries out digital transformation of Samarkand Airport

TAV Technologies has completed the first phase of its project to digitize all operations of Samarkand Airport in line with international standards and the latest technological developments. The signed agreement will further expand the ...

Learn More ->